|rr

of

2021

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. )

AXIS CAPITAL HOLDINGS LIMITED

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| ☒ | ||||||||

| No fee required. | ||||||||

| ☐ | ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| Fee paid previously with preliminary materials. | ||||||||

| ☐ | ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

of

2021

24, 2023

You

As permitted by the rules of the Securities and Exchange Commission, we are also pleased to be furnishing our proxy materials to shareholders primarily over the Internet. We believe this process expedites shareholders’ receipt of the materials, lowers the costs of the Annual General Meeting and conserves natural resources. We sent a Notice of Internet Availability of Proxy Materials on or about March 26, 2021 to our beneficial shareholders at the close of business on March 12, 2021. The notice contains instructions on how to access our Proxy Statement and 2020 Annual Report and vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice.

Bermuda.

Chairman

|

Thursday, May | |||||||||||||||

| ||||||||||||||||

|

| |||||||||||||||

| AXIS House 92 Pitts Bay Road Pembroke HM 08 Bermuda Directions and instructions on how to attend the 2023 Annual General Meeting in person may be obtained by contacting our Corporate Secretary at: 1-441-496-2600. | |||||||||||||||

|

| |||||||||||||||

| ||||||||||||||||

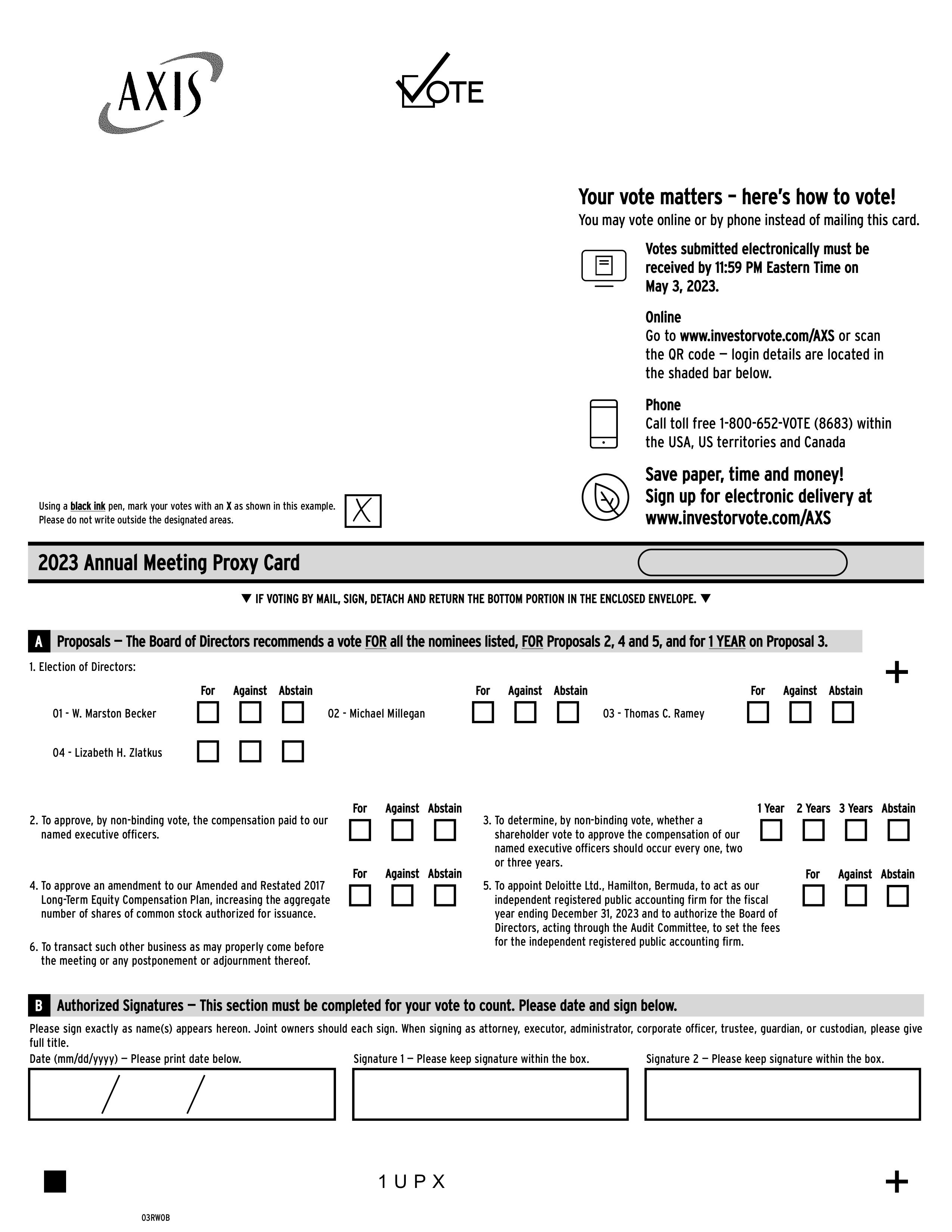

| To elect the four Class | ||||||||||||||||

| 2. | To approve, by non-binding vote, the compensation paid to our named executive officers; | |||||||||||||||

| 3. | To determine, by non-binding vote, whether a shareholder vote to approve the compensation of our named executive officers should occur every one, two or three years; | |||||||||||||||

| 4. | To approve an amendment to our Amended and Restated 2017 Long-Term Equity Compensation Plan, increasing the aggregate number of shares of common stock authorized for issuance; | |||||||||||||||

| 5. | To appoint Deloitte Ltd., Hamilton, Bermuda, to act as our independent registered public accounting firm for the fiscal year ending December 31, | |||||||||||||||

| 6. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. | |||||||||||||||

| ||||||||||||||||

| Close of business on March | |||||||||||||||

| ||||||||||||||||

| G. Christina Gray-Trefry Corporate Secretary March 24, 2023 | ||||||||||||||||

Conrad D. Brooks

Corporate Secretary

March 26, 2021

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting to be held on May 7, 2021: This Notice of Annual General Meeting of Shareholders and Proxy Statement are being distributed or made available, as the case may be, on or about March 26, 2021. The Proxy Statement, the 2020 Annual Report to Shareholders and the Form 10-K of AXIS Capital Holdings Limited for 2020 are available at https://materials.proxyvote.com/G0692U.

PLEASE VOTE VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE VOTING INSTRUCTIONS PRINTED ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ATTACHED PROXY STATEMENT.

Important Notice Regarding the Availability of | |||||||||||||||

Your vote is very important. Whether or not you plan to attend the Annual Meeting, please vote at your earliest convenience by following the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card you received in the mail. You may revoke your proxy at any time before it is voted. Please refer to “Voting and Meeting Information” for additional information. | |||||||||||||||

| Table of Contents | |||||

Human Capital and Compensation Committee Interlocks and Insider Participation | ||||||||

Other Compensation Topics | ||||||||

Human Capital and Compensation Committee Report | ||||||||

|

|

|

|

92 Pitts Bay Road

Pembroke HM 08

Bermuda

|

|

|

|

|

|

| |||||||

| PROXY STATEMENT SUMMARY | ||||||

|

|

|

|

|

| Annual General Meeting Date and Time | Thursday, May 4, 2023 - 8:30 a.m. ADT | ||||||||||

| Location |  | AXIS House 92 Pitts Bay Road Pembroke HM 08 Bermuda Please refer to "Voting and Meeting Information” for additional information. | |||||||||

| ||||||||||||||

| Agenda and Vote Recommendations | ||||||||||||||

| Proposal | Vote Recommendation | For More Information | ||||||||||||

1.Election of the | ||||||||||||||

|

Transitioning seamlessly to a virtual workplace environment and suspending all nonessential business travel, with limited or no business interruption

Providing employees with regular live updates delivered by our Chief Executive Officer

Furnishing employees with a work-from-home office and technology stipend

Developing educational tools and materials focused on the health and well-being of our employees, including remote working best practices, leadership of virtual teams and managing stress while working from home

Adding half-day well-being days and allowing flexibility with paid time off and sick leave policies for employees directly impacted by COVID-19

Continuous monitoring of health information and shelter-in-place orders to assess the reopening of offices

Maintaining our excellent service standards in a virtual working environment

Launching a virtual broker lounge, giving our brokers convenient, direct access to our underwriters via video, instant messaging or one-click calling

Committing $1 million to support COVID-19 relief efforts, with a portion dedicated to supporting underserved communities disproportionately impacted by the pandemic

| FOR each nominee | Page 4 | ||||||||||||

2.Company's executive compensation | FOR | Page 30 | ||||||||||||

3.Timing of shareholder vote to approve the Company's executive compensation ("Say When on Pay") | 1 YEAR | Page 30 | ||||||||||||

4.Approve an amendment to our Amended and Restated 2017 Long-Term Equity Compensation Plan | FOR | Page 80 | ||||||||||||

5.Appointment of Deloitte Ltd. ("Deloitte") as the Company's independent registered public accounting firm for the 2023 fiscal year | FOR | Page 87 | ||||||||||||

| We may also transact any other business that may properly come before the meeting. As of the date of this proxy statement, we are not aware of any business to be presented for consideration other than the matters described | ||||||||||||||

| ||||||||

| Record Date | March 10, 2023 | |||||||

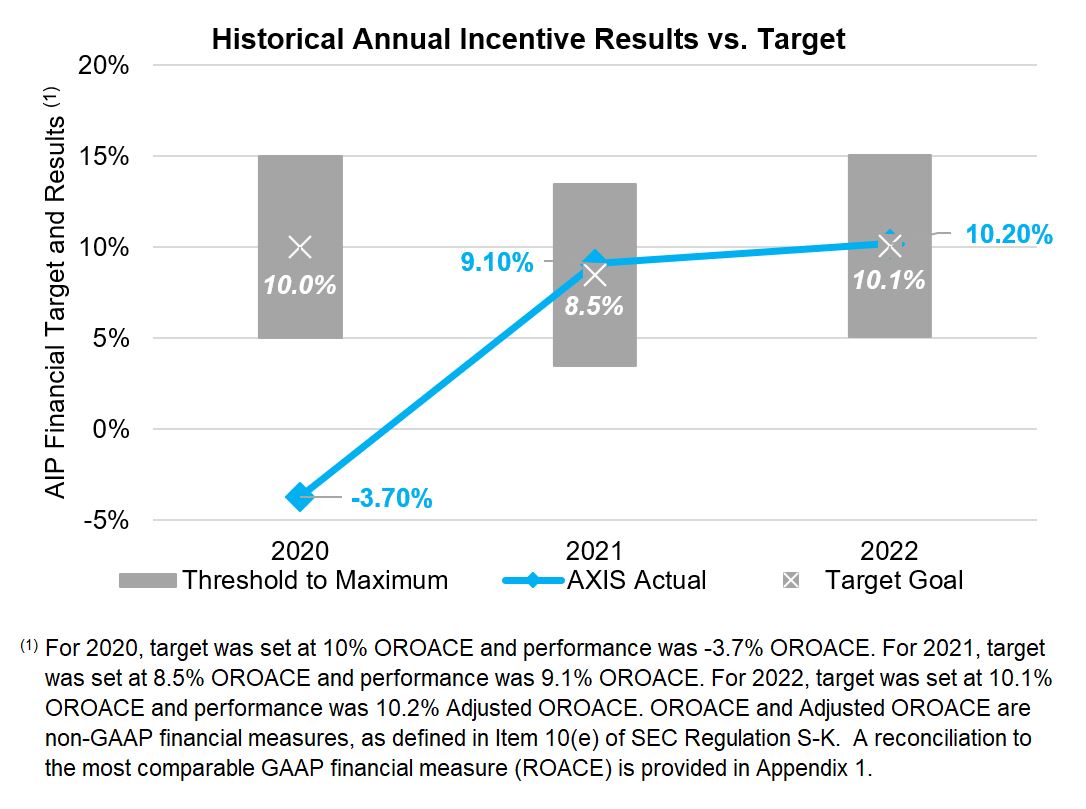

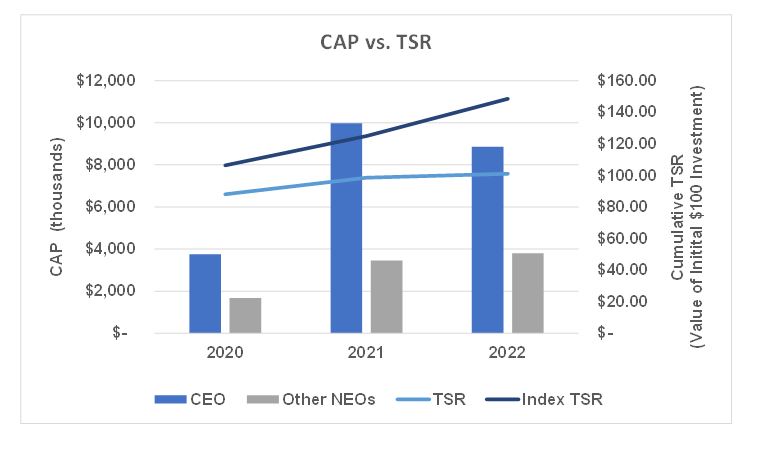

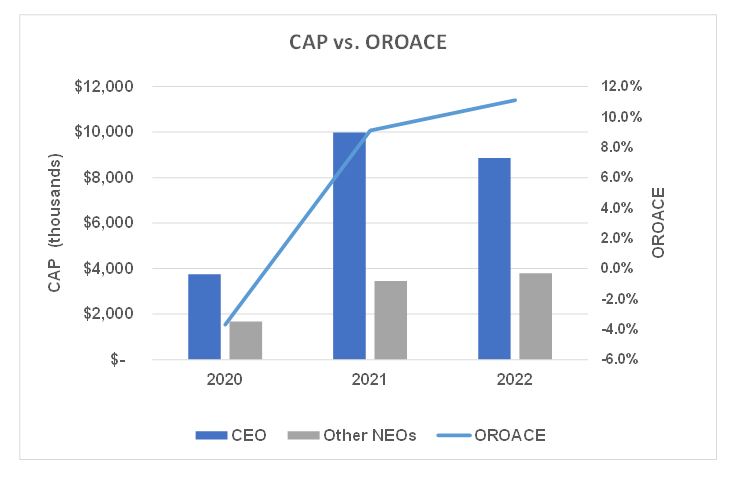

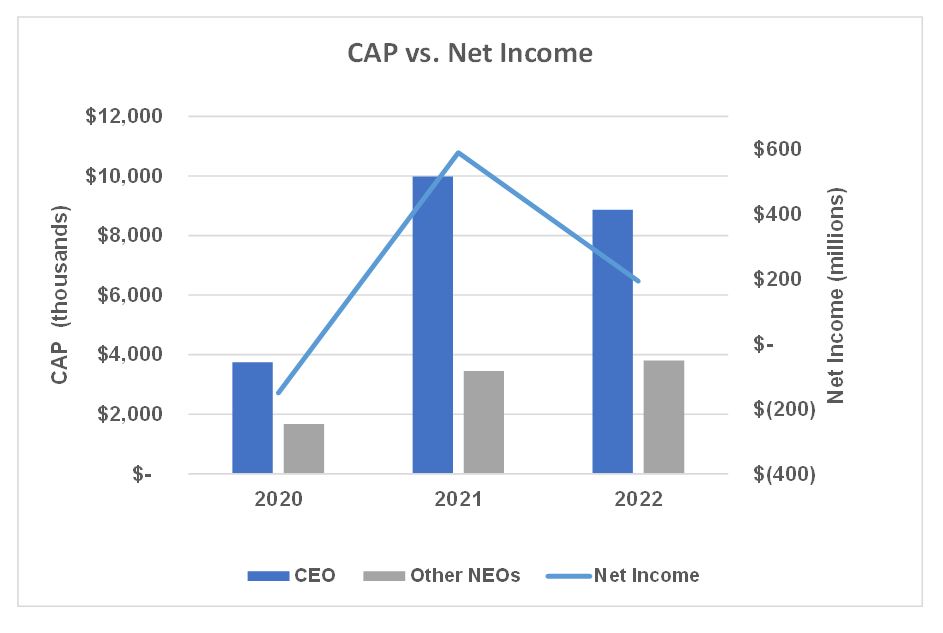

| 2022 Company Financial Performance | In 2022, AXIS advanced its efforts to strengthen its business, reposition its portfolio, reduce volatility, and drive profitable growth in attractive markets - while capitalizing on favorable market conditions. Operating return on average common equity (“OROACE”) AXIS' 2022 financial results for these performance metrics on an absolute basis are set forth below: | |||||||

| ||||||||

| PROXY STATEMENT SUMMARY | 1 | |||||||

| Measure | Fiscal Year 2022 | Change versus Fiscal Year 2021 | ||||||||||||

OROACE(1) | 11.1% | +2.0% pts | ||||||||||||

Adjusted OROACE(2) | 10.2% | N/A | ||||||||||||

ROACE(3) | 4.3% | -7.9% pts | ||||||||||||

Total Shareholder Return(4) | 2.6% | -9.2% pts | ||||||||||||

(1)"OROACE" is operating return on average common equity and is calculated by dividing operating income (loss) for the | ||||||||||||||

| ||||

AXIS Capital’s 2020 financial results for these performance metrics on an absolute basis are set forth below:

(2)"Adjusted OROACE" is operating return on adjusted common equity and is calculated by dividing operating income (loss) for the period by the common shareholders’ equity balance at the beginning of the period. Adjusted OROACE | |||||||||||

is a non-GAAP financial measure as defined in Item 10(e) of SEC Regulation S-K. The reconciliation to the most comparable GAAP financial measure, ROACE, | |||||||||||

| |||||||||||

|

|

|

| . | |||||||||||

|

| ||||||||||

| |||||||||||

(3)"ROACE" is return on average common equity and is calculated by dividing income (loss) available (attributable) to |

| ||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| period. | |||||||||||

| (4)One-year Total Shareholder Return with dividends reinvested, sourced from Bloomberg. | ||||||||||

| |||||||||||

| ||

| ||

| Corporate Citizenship | At AXIS, our purpose is clear: by helping people and organizations around the world manage risk, we give them the confidence to pursue their goals and ambitions. Our Corporate Citizenship program, designed to address environmental, social and governance (ESG) factors and focusing on issues like the impact of climate change and diversity, equity and inclusion (DEI), is one of many ways we help advance this purpose. For more information on the Company’s corporate citizenship initiatives, see "Corporate Governance – Corporate Citizenship & Sustainability." | |||||||||||

| Human Capital Management | We believe our employees distinguish us from our competitors and are critical to our success as a focused specialty underwriter that leads with purpose. As a result, one of our core strategies is to invest in and support our employees, including with respect to health, safety and wellness, DEI, talent development, employee engagement and compensation and benefits. For additional information on our human capital management, please refer to "Corporate Governance – Human Capital Management." | |||||||||||

| Leadership Transition | In December 2022, the Board of Directors implemented a leadership transition, appointing Vincent Tizzio as President and CEO effective May 4, 2023, at which time he will also join the Board. The Board determined that Mr. Tizzio is the right person to lead the organization following our recent transformation due to Mr. Tizzio's deep industry and underwriting expertise in specialty insurance and his ability to further enhance the Company's ability to attract top-tier talent. In addition, the Company announced other senior leadership changes as discussed in "Compensation Discussion and Analysis – Leadership Transition." The Board believes that Mr. Tizzio, together with the rest of the leadership team, is well positioned to execute the Company's strategic imperatives and deliver sustainable profitable growth and increased shareholder value. For more information regarding compensation matters related to AXIS' leadership transition, see "Compensation Discussion and Analysis." | |||||||||||

| |||||||||

| 2 | PROXY STATEMENT SUMMARY |  | |||||||

| Executive Compensation | Key compensation actions for 2022 include: •Paid/accrued severance in accordance with existing contracts relating to non-renewal and termination without cause. •Awarded equity to CEO at below target; other NEOs awarded equity at target. Paid bonuses in line with formula, averaging a payout of 107% of target. •For more information on executive compensation, see "Compensation Discussion and Analysis" and "Executive Compensation." | |||||||

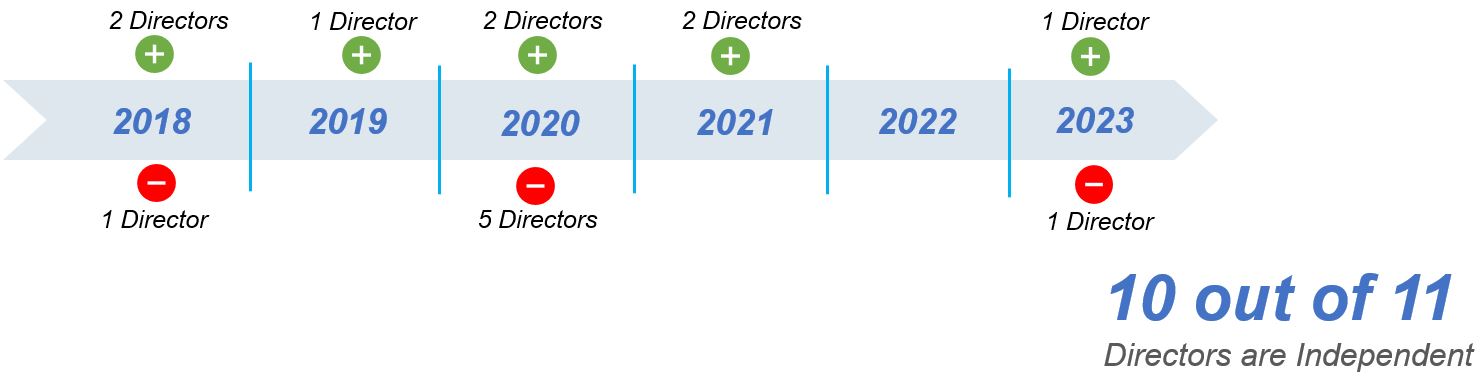

| Corporate Governance Highlights | Corporate governance continues to be an area of significant focus for our Board. Our current governance practices include the following, many of which are discussed in further detail throughout this proxy statement: •Regular shareholder engagement •Annual Board and committee self-evaluations •Majority independent Board and fully independent Audit, Human Capital and Compensation, and Corporate Governance, Nominating and Social Responsibility Committees •None of our directors serve on the board of directors of more than three other publicly-held corporations •Majority vote standard for election of directors •No stockholder rights plan (“poison pill”) •Shareholders holding 10% or more of our outstanding stock have the right to call a special meeting | |||||||

Regular shareholder engagement

Annual Board and committee self-evaluations

Majority independent Board and fully independent Audit, Compensation and Corporate Governance and Nominating Committees

None of our directors serve on the board of directors of more than three other publicly-held corporations

Majority vote standard for election of directors

No stockholder rights plan (“poison pill”)

Shareholders holding 10% or more of our outstanding stock have the right to call a special meeting

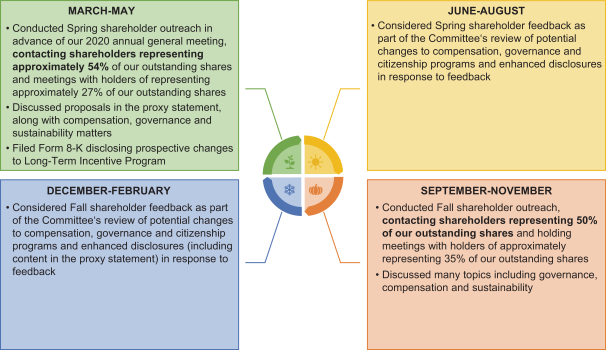

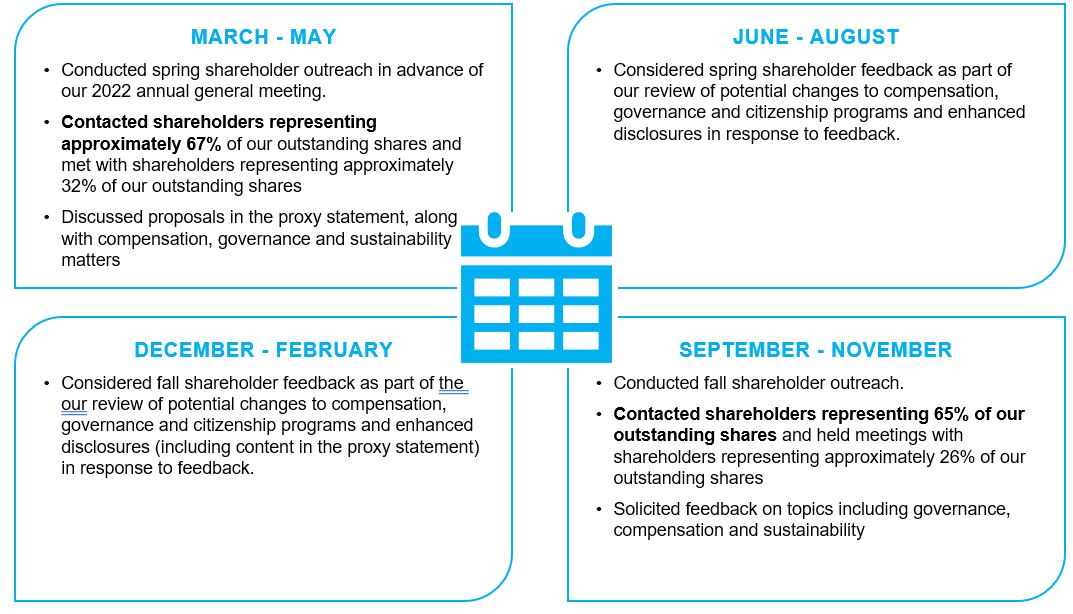

| Shareholder Engagement and Responsiveness to Shareholders | In addition to our regular investor relations efforts, in 2022 we •Henry Smith, our 2022 Human Capital and Compensation Committee Chair and independent Chair of the Board led engagement efforts and actively participated in all of the •Discussion topics included AXIS' strategy, executive compensation and governance practices as well as environmental, social and sustainability topics. For more information on shareholder engagement, see "Compensation Discussion and Analysis – Executive Summary – Positive 2022 Say on Pay Vote and Shareholder Engagement." | |||||||

Henry Smith, our Compensation Committee Chairman, who also served as our Lead Independent Director until his appointment as our independent Chairman, actively participated in a majority of the meetings.

During the meetings, we discussed our executive compensation and governance practices as well as environmental, social and sustainability topics.

Responding to shareholder feedback, changes were made to our compensation program as summarized in “Evolution of our Compensation Program” above and discussed in further detail in “Compensation Discussion and Analysis—Executive Summary, Shareholder Engagement and Responsiveness to 2020 Say on Pay Vote.”

Prompt return of your proxy will help reduce the costs of re-solicitation.

| ||||||||

| PROXY STATEMENT SUMMARY | |||||||

| ||||||||||

| PROPOSAL 1. ELECTION OF DIRECTORS |  | |||||||||

| DIRECTORS |  |

|  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||||

EXPERIENTIAL CRITERIA (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Public Company Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||

Digital Experience |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||||||||||||||

Insurance Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||||

Reinsurance Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||||||||||

Finance Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||

International Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||

Banking Experience |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||||||||

Legal/Regulatory Experience |

| ✓ |

| ✓ |

| ✓ | |||||||||||||||||||||||||||||||||||||||||||||||||

COMPOSITION | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other Current U.S.-Listed Public Boards |

| 1 |

| 0 |

| 2 |

| 0 |

| 0 |

| 3 |

| 0 |

| 0 |

| 0 |

| 2 |

| 2 | |||||||||||||||||||||||||||||||||

Average Age = 64.5 years |

| 68 |

| 63 |

| 72 |

| 62 |

| 48 |

| 62 |

| 77 |

| 72 |

| 63 |

| 61 |

| 62 | |||||||||||||||||||||||||||||||||

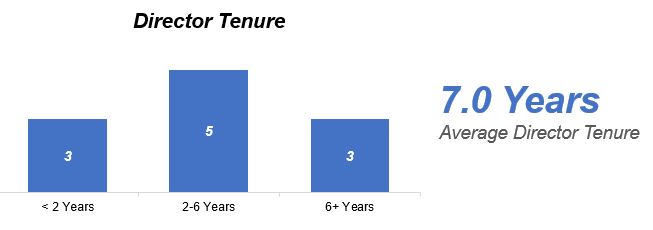

Average Tenure = 5.9 years |

| .8 |

| 9 |

| 18 |

| 1.3 |

| 2.3 |

| 0 |

| 11.7 |

| 16.9 |

| 0 |

| 2.8 |

| 2 | |||||||||||||||||||||||||||||||||

Racially/Ethnically Diverse |

| ◾ | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Gender Diverse |

| ◾ |

| ◾ |

| ◾ |

| ◾ | |||||||||||||||||||||||||||||||||||||||||||||||

|

DIRECTORS(1) | Becker | Davis | Dowling | Hardwick | Millegan | Ramey | Smith | Theis | Tizzio | Yastine | Zlatkus | ||||||||||||||||||||||||

EXPERIENTIAL CRITERIA (1) | |||||||||||||||||||||||||||||||||||

| Public Company Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||

| Digital Experience | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||

| Insurance Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

| Reinsurance Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

| Finance Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

| International Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

| Banking Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||

| Legal/Regulatory Experience | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||

| COMPOSITION | |||||||||||||||||||||||||||||||||||

| Other Current U.S.-Listed Public Boards | 1 | 1 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 3 | 1 | ||||||||||||||||||||||||

| Average Age = 65.7 years | 70 | 74 | 64 | 50 | 64 | 79 | 74 | 65 | 56 | 63 | 64 | ||||||||||||||||||||||||

| Average Tenure = 7.0 years | 2.8 | 21.3 | 3.2 | 4.4 | 1.9 | 13.7 | 18.9 | 2.0 | - | 4.7 | 4.0 | ||||||||||||||||||||||||

| Racially/Ethnically Diverse | = | ||||||||||||||||||||||||||||||||||

| Gender Diverse | = | = | = | = | |||||||||||||||||||||||||||||||

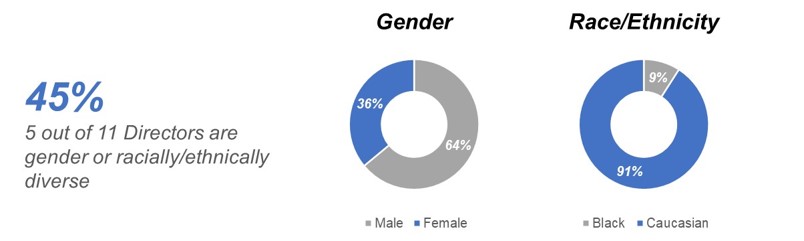

Emphasizesprocess emphasizes the importance of diversity;diversity, including diversity of race, gender identity, age, sexual orientation, ethnicity and

Focuses national origin, geographic location and cultural background. Our process is also focused on expanding the collective skills and experience of our Board with our new directors bringing deep industry and financial expertise, regulatory experience, innovative thinking and strategic perspective.

| ||||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | |||||||

The

| ||||||||

| 6 | PROPOSAL 1. ELECTION OF DIRECTORS | |||||||

| Name | Age | Class | Position | Since | ||||||||||

W. Marston Becker(1) | 70 | II | Independent Director | June 2020 | ||||||||||

Michael Millegan(1) | 64 | II | Independent Director | April 2021 | ||||||||||

| Thomas C. Ramey | 79 | II | Independent Director | July 2009 | ||||||||||

| Lizabeth H. Zlatkus | 64 | II | Independent Director | March 2019 | ||||||||||

W. Marston Becker | ||||||||

| Experience: •Served as Chairman of the Board of QBE Insurance Group from 2014 until April 2020. •Served as Chairman and Chief Executive Officer of Alterra Capital Holdings Limited from 2006 to 2013, Trenwick Group, Ltd. from 2002 to 2005, the run-off for LaSalle Re Holdings from 2002 to 2008 and Orion Capital Corporation from 1996 to 2000. •Served as President and Chief Executive Officer of McDonough Caperton Insurance Group, Inc. from 1987 to 1994. •Holds the Chartered Financial Analyst designation and is an admitted attorney in West Virginia. Education: B.A. from West Virginia University and J.D. from West Virginia University U.S. Public Company Boards:MVB Financial Corp. Key Qualifications: The Board believes that Mr. Becker is qualified to serve as a director based on his 37 years of experience, including Chief Executive Officer and Chairman leadership positions in the insurance and financial industries. Committee Membership: Chair of the Risk Committee and Member of the Executive and Human Capital and Compensation Committees | |||||||

| ||||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | 7 | |||||||

| Michael Millegan | ||||||||

| Experience: •Has served as Founder and Chief Executive Officer of Millegan Advisory Group-3 LLC, a strategic advisory firm for early-stage companies since February 2014. •Held executive leadership and management roles at Verizon over the course of his 33-year tenure in the areas of digital technology and platforms, cybersecurity, supply chain management, sales, marketing and operations, including President of Verizon Global Wholesale Group, President of Verizon Digital Media Service, Area President of Verizon Midwest Region and Senior Vice President of Verizon Enterprise Operations. Education:B.A. from Angelo State University and M.B.A. from Angelo State University U.S. Public Company Boards:Portland General Electric Company and Wireless Telecom Group, Inc. Former director of CoreSite Realty Corporation from February to December 2021 prior to its acquisition by American Tower Corporation. Key Qualifications: The Board believes that Mr. Millegan is qualified to serve as a director based on his 33 years of leadership experience, including his experience running a business to business network and working with global companies, along with his knowledge in the areas of digital technology and platforms, cybersecurity, supply chain management, sales, marketing and operations. Committee Membership: Chair of the Human Capital and Compensation Committee and Member of the Finance Committee | |||||||

| Thomas C. Ramey | ||||||||

| Experience: •Former Chairman and President of Liberty International, a wholly owned subsidiary of Liberty Mutual Group, from 1997 to 2009. Also served as Executive Vice President of Liberty Mutual Group from 1995 to 2009. •Served as President and Chief Executive Officer of American International Healthcare, a subsidiary of AIG, from 1986 to 1992. •Founder and President of an international healthcare trading company, including health maintenance organization (HMO) consulting and management. Education: B.A. from Texas Tech University and M.A. from Tulane University U.S. Public Company Boards:Former director of UroCor, Inc. from 1996 to 2001 prior to its acquisition by Dianon Systems Inc. Key Qualifications: The Board believes that Mr. Ramey is qualified to serve as a director based on his extensive insurance industry knowledge and significant background in international insurance operations, acquisitions and management. Committee Membership: Member of the Audit Committee and Corporate Governance, Nominating and Social Responsibility Committee | |||||||

| ||||||||||||

|

| Lizabeth H. Zlatkus | ||||||||||||

|  | |||||||||||

| Experience: |

Current Chief Executive Officer of Stone Point Capital LLC, serving since June 2005.

From 1998 until May 2005, held various executive positions at MMC Capital, Inc., a subsidiary of Marsh & McLennan Companies, Inc., serving as the Chief Executive Officer from 1999 to 2005 and as Chairman from 2002 to 2005. Also served as a Vice Chairman of Marsh & McLennan Companies, Inc. from 1999 to November 2004.

Spent 23 years at Goldman Sachs & Co. LLC, where, among other positions, Mr. Davis served as head of Investment Banking Services worldwide; head of the Financial Services Industry Group; General Partner; Senior Director; and Limited Partner.

•Served in various senior leadership positions during her tenure with The Hartford Financial Services Group from 1983 to 2011, including Chief Financial Officer and Chief Risk Officer of the Education:B.S. from |

| Pennsylvania State University U.S. Public Company Boards: |

| Boston Private Financial Holdings, Inc. from 2015 to 2021. Key Qualifications:The Board believes that Committee Membership:Chair of |

|

Former Chief Digital Officer of UBS, leading the bank’s innovation and digitization activities across all business lines and functions globally, serving from 2018 to June 2020.

Served as Head of Innovation of Deutsche Bank from 2016 to 2018, leading innovation across business lines and functions globally and supporting the company’s digital strategy development.

From 2011 to 2016, served as Chief Executive Officer of Credit Benchmark Ltd., a FinTech start-up and provider of credit risk data, leading the company from its foundation.

Held a succession of senior leadership positions at Thomson Reuters from 2005 to 2011 including Global Head of Strategy, Investment and Advisory; Global Head of Professional Publishing; and Head of Strategy for Europe and Asia.

Held positions at Morgan Stanley International from 2002 to 2005; Booz-Allen & Hamilton from 1997 to 2000; and the United Kingdom’s Department of Trade and Industry from 1995 to 1997.

Education: M.A. from the University of Cambridge and M.B.A. from Harvard Business School

| ||||

|

Served in various management roles during his distinguished 33-year career with Allianz SE, including as a member of the Allianz Board of Management from 2015 to 2020; Chief Executive Officer of Allianz Global Corporate & Specialty SE from 2006 to 2014; and Chief Executive Officer of Allianz Global Risks Ruckversicherungs from 2004 to 2006.

Also served on Allianz’s U.K. subsidiary board as Chairman from 2015 to 2018, as a member of the U.S. and Irish subsidiaries of Allianz from 2015 to 2018 and as Chairman of Allianz’ French credit insurance company, Euler Hermes from 2015 to 2019.

|

Former Chair and Chief Executive Officer of Ally Bank, a digital banking leader. Served as Chair from 2010 to 2015 and became interim Chief Executive Officer and President in 2011 before serving as Chief Executive Officer and President beginning in 2012. Also served as Chief Administrative Officer of Ally Financial from 2010 to 2012.

Previously served on the Board of First Data Corporation from 2016 to July 2019 and also as a director and co-Chief Executive Officer of privately held Lebenthal Holdings, LLC from September 2015 to June 2016. In November 2017, Lebenthal and certain of its subsidiaries filed voluntary petitions for bankruptcy under Chapter 7 of the United States Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of New York.

Held various executive roles at Citigroup and Credit Suisse First Boston spanning over 17 years.

Recommendation of the Board

| ||||||||||

| PROPOSAL 1. ELECTION OF DIRECTORS |  | 9 | ||||||||

| Name | Age | Class | Position | Since | ||||||||||

Vincent C. Tizzio(1) | 56 | III | Chief Executive Officer and President | May 2023 | ||||||||||

| Charles A. Davis | 74 | I | Independent Director | November 2001 | ||||||||||

| Anne Melissa Dowling | 64 | III | Independent Director | January 2020 | ||||||||||

| Elanor R. Hardwick | 50 | I | Independent Director | November 2018 | ||||||||||

| Henry B. Smith | 74 | III | Independent Director | May 2004 | ||||||||||

| Axel Theis | 65 | I | Independent Director | April 2021 | ||||||||||

| Barbara A. Yastine | 63 | I | Independent Director | July 2018 | ||||||||||

| Vincent C. Tizzio | ||||||||

| Experience: •Serves as our CEO Specialty Insurance and Reinsurance and will become our President and Chief Executive Officer, effective May 4, 2023. Prior to becoming CEO Specialty Insurance and Reinsurance, served as a Senior Advisor - Insurance Market Strategy from January 2022 to June 2022. •Served as Executive Vice President and Head of Global Specialty at The Hartford from May 2019 through August 2021. •Prior to joining The Hartford, Mr. Tizzio spent seven years as President and CEO of Navigators Management Company. Education:B.S. from Adelphi University U.S. Public Company Boards:None Key Qualifications:The Board believes that Mr. Tizzio is qualified to serve as a director based on his deep knowledge of the specialty insurance industry and his proven track record of managing an insurance business, with a comprehensive understanding of underwriting and go to market strategies. Committee Membership: Member of Executive Committee, effective May 4, 2023 | |||||||

| ||||||||

| 10 | PROPOSAL 1. ELECTION OF DIRECTORS | |||||||

| Charles A. Davis | ||||||||||||||

| Experience: •Current Chief Executive Officer | |||||||||||||

| of Stone Point Capital LLC, serving since June | ||||||||||||||

•Held various executive positions at MMC Capital, Inc., a subsidiary of Marsh & McLennan Companies, Inc., from 1998 until May 2005, serving as the Chief Executive Officer from 1999 to 2005 and as Chairman •Spent 23 years at Goldman Sachs & Co. LLC, where, among other positions, Mr. Education:B.A. from the |

|

|

Served as the Chief Executive Officer and President of W.P. Stewart & Co., Ltd. from May 2005 to March 2006.

Former Chief Executive Officer of the Bank of Bermuda Limited from March 1997 to March 2004.

Joined the Bank of Bermuda in 1973 serving in various senior positions including Executive Vice President and Chief Operations Officer; Executive Vice President Europe; and Senior Vice President and General Manager, Retail Banking.

| Columbia Business School U.S. Public Company |

| Boards:The Progressive Corporation. Former director of The Hershey Company from 2007 to 2021. Key |

|

Has served as our President and Chief Executive Officer since May 2012. He previously served as our Executive Vice President and Chief Financial Officer from January 2011 until May 2012.

Served as Executive Vice President and Chief Financial Officer of PartnerRe Ltd. from April 2000 through September 2010 and as Chief Executive Officer of PartnerRe Ltd.’s Capital Markets Group business unit from June 2007 through September 2010.

Prior to joining PartnerRe, Mr. Benchimol was Senior Vice President and Treasurer at Reliance Group Holdings, Inc. for 11 years and was previously with the Bank of Montreal from 1982 to 1989.

Committee Membership: Member of Finance Committee, Executive |

| Committee |

| ||||||||

|

Served as Chairman of the Board of QBE Insurance Group from 2014 until April 2020.

Served as Chairman and Chief Executive Officer of: Alterra Capital Holdings Limited from 2006 to 2013, Trenwick Group, Ltd. from 2002 to 2005, the run-off for LaSalle Re Holdings from 2002 to 2008 and Orion Capital Corporation from 1996 to 2000.

Served as President and Chief Executive Officer of McDonough Caperton Insurance Group, Inc. from 1987 to 1994.

Holds the Chartered Financial Analyst designation and is an admitted attorney in West Virginia.

Anne Melissa Dowling | ||||||

Served as Director of Insurance for the State of Illinois from 2015 to 2017 and as Deputy Commissioner of Insurance for the State of Connecticut from 2011 to 2015.

Held executive management roles in the areas of investments, treasury, strategic planning and marketing and governance at Massachusetts Mutual Financial Group; Connecticut Mutual Life Insurance Company; Travelers Insurance Company; and at Aetna Life & Casualty, where she began her career in 1982.

Holds the Chartered Financial Analyst designation.

| Experience: •Served as Director of Insurance for the State of Illinois from 2015 to 2017 and as Deputy (and Acting) Commissioner of Insurance for the State of Connecticut from 2011 to 2015. •Held executive management roles in the areas of investments, treasury, strategic planning and marketing and governance at Massachusetts Mutual Financial Group; Connecticut Mutual Life Insurance Company; Travelers Insurance Company; and at Aetna Life & Casualty, where she began her career in 1982. •Holds the Chartered Financial Analyst designation. Education:B.A. from Amherst College and M.B.A. from Columbia Business School |

U.S. Public Company |

Key Committee Membership: Chair of Finance Committee and Member of Risk Committee |

| ||||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | 11 | |||||||

| Elanor R. Hardwick | ||||||||

| Experience: •Former Chief Digital Officer of UBS, leading the bank’s innovation and | |||||||

|

Serves as Founder and Chief Executive Officer of Millegan Advisory Group-3 LLC, a strategic advisory firm for early-stage companies.

Held executive leadership and management roles at Verizon over the course of his 33-year tenure, including President of Verizon Global Wholesale Group, Area President of Verizon Midwest Region and Senior Vice President of Verizon Enterprise Operations.

•Served as Head of Innovation of Deutsche Bank from 2016 to 2018, leading innovation across business lines and functions globally and supporting the company’s digital strategy development. •Served as Chief Executive Officer from 2011 to 2016, of Credit Benchmark Ltd., a FinTech start-up and provider of credit risk data, leading the company from its foundation. •Held a succession of senior leadership positions at Thomson Reuters from 2005 to 2011 including Global Head of Strategy, Investment and Advisory; Global Head of Professional Publishing; and Head of Strategy for Europe and Asia. •Held positions at Morgan Stanley International from 2002 to 2005; Booz-Allen & Hamilton from 1997 to 2000; and the United Kingdom’s Department of Trade and Industry from 1995 to 1997. Education:M.A. from the University of Cambridge and M.B.A. from |

| Harvard Business School U.S. Public Company |

Boards:None |

| Henry B. Smith | ||||||||

| Experience: •Served as the Chief Executive Officer and President of W.P. Stewart & Co., Ltd. from May 2005 to March 2006. •Former Chief Executive Officer of the Bank of Bermuda Limited from March 1997 to March 2004. •Joined the Bank of Bermuda in 1973 serving in various senior positions including Executive Vice President and Chief Operations Officer; Executive Vice President Europe; and Senior Vice President and General Manager, Retail Banking. Education:B.A. from Trinity College-Hartford U.S. Public Company Boards:None Key Qualifications:The Board believes that Mr. Committee Membership:Chair of Executive Committee | |||||||

| ||||||||

| 12 | PROPOSAL 1. ELECTION OF DIRECTORS | |||||||

| Axel Theis | ||||||||

| Experience: •Served in various management roles during his distinguished 33-year career with Allianz SE, including as a member of the Allianz Board of Management from 2015 to 2020; Chief Executive Officer of Allianz Global Corporate & Specialty SE from 2006 to 2014; and Chief Executive Officer of Allianz Global Risks Ruckversicherungs from 2004 to 2006. •Also served on Allianz’s U.K. subsidiary board as Chairman from 2015 to 2018, as a member of the U.S. and Irish subsidiaries of Allianz from 2015 to 2018 and as Chairman of Allianz’ French credit insurance company, Euler Hermes from 2015 to 2019. Education:Ph.D. from the Eberhard Karls Universität Tübingen U.S. Public Company Boards:None Key Qualifications:The Board believes Dr. Theis is qualified to serve as a director based on his 33 years of Committee Membership:Member of Audit and Risk Committees | |||||||

| Barbara A. Yastine | ||||||||

| Experience: •Former Chair and Chief Executive Officer of Ally Bank, a digital banking leader. Served as Chair from 2010 to 2015 and became interim Chief Executive Officer and President in 2011 before serving as Chief Executive Officer and President beginning in 2012. Also served as Chief Administrative Officer of Ally Financial from 2010 to 2012. •Previously served on the Board of First Data Corporation from 2016 to July 2019 and also as a director and co-Chief Executive Officer of privately held Lebenthal Holdings, LLC from September 2015 to June 2016. In November 2017, Lebenthal and certain of its subsidiaries filed voluntary petitions for bankruptcy under Chapter 7 of the United States Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of New York. •Held various executive roles at Citigroup and Credit Suisse First Boston spanning over 17 years. Education:B.A. in Journalism from New York University and M.B.A. from New York University U.S. Public Company Boards:Primerica, Inc., Zions Bancorporation and Alkami Technology, Inc. Key Qualifications:The Board believes that Ms. Yastine is qualified to serve as a director based on her more than 30 years of management experience in the financial services and risk management sectors, including her prior role as Chair, Chief Executive Officer and President of Ally Bank. Committee Membership:Chair of the Corporate Governance, Nominating and Social Responsibility Committee and Member of the Audit Committee | |||||||

| ||||||||

| PROPOSAL 1. ELECTION OF DIRECTORS |  | 13 | ||||||

| ||||||||

| Albert A. Benchimol | ||||||||

| Experience: •Has served as our President and | |||||||

•Served as Executive Vice President and |

|

Former Chairman and President of Liberty International, a wholly owned subsidiary of Liberty Mutual Group, from 1997 to 2009. Also served as Executive Vice President of Liberty Mutual Group from 1995 through 2009.

Served as President and Chief Executive Officer of American International Healthcare, a subsidiary of AIG.

Founder and President of an international healthcare trading company.

•Prior to joining PartnerRe, Mr. Benchimol was Senior Vice President and Treasurer at Reliance Group Holdings, Inc. for 11 years and was previously with the Bank of Montreal from 1982 to 1989. Education:B.S. from McGill University and |

U.S. Public Company |

Key |

|

Served in various senior leadership positions during her tenure with The Hartford Financial Services Group from 1983 to 2011, including Chief Financial Officer and Chief Risk Officer of the firm and Co-President of Hartford Life Insurance Companies and as Executive Vice President of The Hartford’s international operations and the group life and disability divisions.

Education: B.S. from Pennsylvania State University

Committee Membership: Member of Executive Committee |

| ||||||||

| PROPOSAL 1. ELECTION OF DIRECTORS | |||||||

The Board also considers the recommendations of the Corporate Governance, Nominating and Social Responsibility Committee which thoughtfully assesses independence on an annual basis, regularly tracks and considers fees paid to Stone Point Capital LLC and its affiliates ("Stone Point") and other factors as well as the advice of outside counsel experienced in these matters.

| ||||||||

| CORPORATE GOVERNANCE | 15 | |||||||

| ||||||

Related persons include any of our directors, director nominees or executive officers, certain of our shareholders and their respective immediate family members. A conflict of interest occurs when an individual’s private interest interferes, or appears to interfere, in any way with our interests.

During 2020, Mr. Butt, who served as our Chairman until his retirement in September 2020, received $400,000 in consulting fee payments pursuant Further, directors are requested to the termsdisclose any new conflicts of interest at each quarterly board meeting, and they are expected to recuse themselves from any matters involving a consulting agreement by andpotential conflict.

and affiliates of Stone Point, a private equity firm that specializes in the insurance and financial services industry, including owning several specialized investment managers. Charles A. Davis is the Chief Executive Officer of Stone Point.

Additionally, we have committed to invest $71 million to Stone Point’s private equity fund, Trident VIII L.P. In 2020, we paid $1.1 million in management fees to Stone Point in connection with our investment in Trident VIII L.P.

We also have approximately $38 million invested in the Freedom Consumer Credit Fund, LLC Series B, the manager of which is Freedom Financial Asset Management, LLC, an indirect subsidiary of Pantheon Partners, LLC.LLC (“Pantheon”). Investment funds managed by Stone Point own approximately 14.5% of Pantheon Partners, LLC.Pantheon. During 2020, management2022, fees paid to Freedom Financial Asset Management, LLC totaled $2$1.7 million.

In January 2021, we committed to invest $30

| ||||||||

| 16 | CORPORATE GOVERNANCE | |||||||

| Name | Audit | Compensation | Corporate Governance and Nominating | Finance | Risk | Executive | Independent Director | |||||||

| W. Marston Becker | Member | Member | Chair | Member | X | |||||||||

| Albert A. Benchimol | Member | Member | ||||||||||||

| Charles A. Davis | Chair | Member | Member | X | ||||||||||

| Anne Melissa Dowling | Member | Member | Member | Member | X | |||||||||

| Elanor R. Hardwick | Member | Member | Member | X | ||||||||||

| Michael Millegan | Member | Member | X | |||||||||||

| Thomas C. Ramey | Member | Member | Member | X | ||||||||||

| Henry B. Smith | Chair | Member | Chair | X | ||||||||||

| Axel Theis | Member | Member | X | |||||||||||

| Barbara A. Yastine | Member | Chair | Member | X | ||||||||||

| Lizabeth H. Zlatkus | Chair | Member | Member | X | ||||||||||

| 2020 Meetings | 10 | 9 | 5 | 5 | 4 | 0 | ||||||||

| ||||

| Name | Audit | Human Capital and Compensation | Corporate Governance, Nominating and Social Responsibility | Finance | Risk | Executive | Independent Director | ||||||||||||||||

| W. Marston Becker | Member | Chair | Member | X | |||||||||||||||||||

| Charles A. Davis | Member | Member | Member | X | |||||||||||||||||||

| Anne Melissa Dowling | Chair | Member | X | ||||||||||||||||||||

| Elanor R. Hardwick | Member | Member | X | ||||||||||||||||||||

| Michael Millegan | Chair | Member | X | ||||||||||||||||||||

| Thomas C. Ramey | Member | Member | X | ||||||||||||||||||||

| Henry B. Smith | Chair | X | |||||||||||||||||||||

| Axel Theis | Member | Member | X | ||||||||||||||||||||

| Vincent C. Tizzio | Member | ||||||||||||||||||||||

| Barbara A. Yastine | Member | Chair | X | ||||||||||||||||||||

| Lizabeth H. Zlatkus | Chair | Member | Member | X | |||||||||||||||||||

| 2022 Meetings | 8 | 8 | 6 | 4 | 4 | 0 | |||||||||||||||||

| ||||||||

| CORPORATE GOVERNANCE | 17 | |||||||

covenants and making recommendations to the Board concerning the Company's dividend policy.

| ||||||

The Board believes that the role of a Lead Independent Director can enhance effective governance. During Mr. Butt’s tenure as non-independent Chairman in 2020, Mr. Smith served as the Lead Independent Director. In September 2020, Mr. Smith was appointed as independent Chairman. In addition to presiding at executive sessions of the non-management directors as well as all meetings at which the Chairman is not present, the Lead Independent Director’s duties included:

providing input on meeting scheduling, agendas and information that is provided to the Board;

acting as a liaison between the independent directors and the former Chairman;

recommending, as appropriate, that the Board retain consultants who will report directly to the Board; and

consulting and communicating with major shareholders on a per-request basis.

Under the Company’s Corporate Governance Guidelines, the Company no longer requires a Lead Independent Director since Mr. Smith qualifies as an independent Chairman.

in connection with a broader effort to streamline committee membership.

| ||||||||

| 18 | CORPORATE GOVERNANCE | |||||||

•the name, age and business and residence addresses of the candidate;

•the principal occupation or employment of the candidate;

•the number of common shares or other securities of the Company beneficially owned by the candidate;

| ||||

•all other information relating to the candidate that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Exchange Act; and

•the candidate’s written consent to be named in the proxy statement and to serve as a director if elected.

agendas.

| ||||||||

| CORPORATE GOVERNANCE | 19 | |||||||

| ||||||

employees, including our Chief Executive Officer and President, Chief Financial Officer and Global Corporate Controller, and are available on our website at www.axiscapital.com.www.axiscapital.com. We intend to disclose on our website any required amendment to, or waiver of, a provision of the Code of Business Conduct that applies to our Chief Executive Officer and President, our Chief Financial Officer or our Global Corporate Controller. In addition, waivers of the Code of Business Conduct for our directors and executive officers may be made only by our Board or the Corporate Governance, Nominating and NominatingSocial Responsibility Committee and will be promptly disclosed to shareholders on our website in accordance with the listing standards of the NYSE. All directors, officers and employees are required to certify their compliance with our Code of Business Conduct and Corporate Governance Guidelines annually.

plan.

of Directors and the Forbes 2022 America's Best Midsize Employers award.

Our Businessoperations, and Exposures – We believe that (re)insurers have an important role to play in mitigating climate risk, transitioning to a low-carbon economy and protecting our planet. In 2020, we continued to mitigate climate risk. In particular, our policy to limit thermal coal and oil sands underwriting and investment went into effect on January 1, 2020 and by year end, we committed to not underwrite new insurance or facultative reinsurance contracts, or provide investment support, for projects covering the exploration, production or transportation of oil and gas in the Arctic National Wildlife Refuge. As part of our commitment to transition to a low-carbon economy, we were proud to continue to be a top global player in the renewable energy insurance space – a line of business in which we continue to invest. We also completed an assessment report of climate risks acrosstrack our product lines and continued to advance and monitor the latest science on climate change through our NatCat Centre of Excellence, the AXIS Research Center at the University of Illinois, our global climate-change working group and local modeling teams. We also model and review peril regions most likely to be affected by climate risk.

Our Operations –GHG emissions. We completed a comprehensive assessment of our 20192020 and 2021 greenhouse gas emissions and plan to use the results of our assessmentwhich we used to inform our strategyGHG reduction goals related to mitigateScope 1 and Scope 2 emissions. In addition, we signed the Global Supply Chain Pledge launched by the Insurance Task Force of the Sustainable Markets Initiative to advance sustainable action in our supply chain.

| ||||||||

| 20 | CORPORATE GOVERNANCE | |||||||

| ||||||||

| CORPORATE GOVERNANCE | 21 | |||||||

| ||||||||

| 22 | CORPORATE GOVERNANCE | |||||||

| ||||||||

| CORPORATE GOVERNANCE | 23 | |||||||

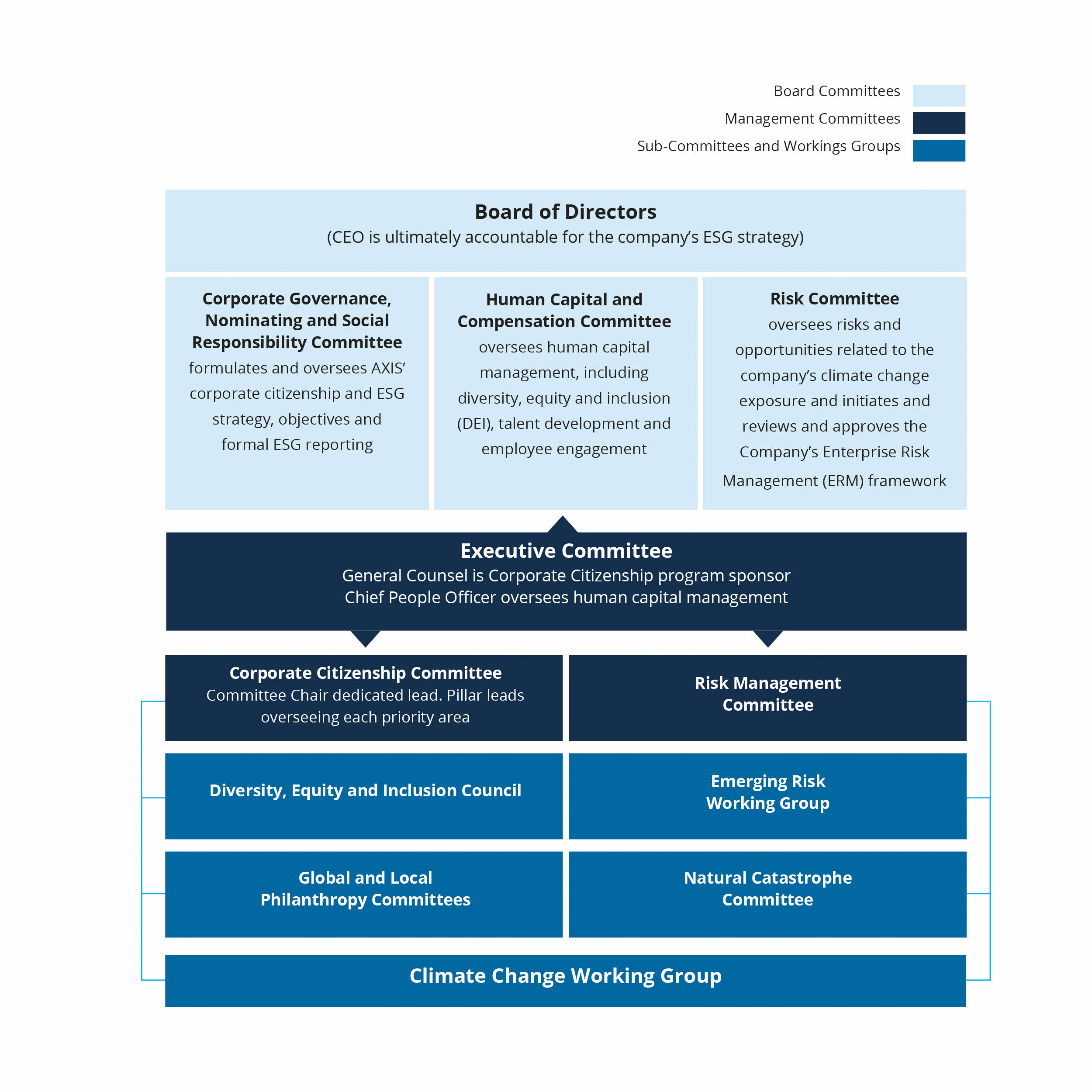

Our Board, along with our Corporate Governance, Nominating and Social Responsibility Committee.

| ||||

A keyother senior executives, is responsible for ensuring that our ESG initiatives are consistent with our culture, values and business objectives.

AXIS established a Diversity & Inclusion Council comprised of global employees representing a full spectrum of experiences and viewpoints. The Council, in partnership with AXIS’ dedicated diversity, equity and inclusion lead, identifies, prioritizes and enacts annual diversity, equity and inclusion goals that are aligned and embedded in our corporate initiatives.recommendations. The Council is supported by an ancillary group of Diversity & InclusionDEI Advocates who actively engage and promote the work of the Council.

AXIS introduced various diversity, equity and inclusion educational initiatives, such as monthly “knowledge tests” on a range

We continuedcontributed to broaden our recruiting strategies to identify, recruit and develop a diverse pipeline of candidates. Recent initiatives include:

|

|

|

|

|

AXIS established quarterly measurement of diverse hiring, turnover, promotions, succession planning and candidate slates. In support of this work, AXIS also measures gender pay gap semi-annually and conducts annual pay audits. We also continued to partner with a human capital analytics firm that advises companies with respect to diversity, equity and inclusion metrics to help us set, track and consistently improve our diversity, equity and inclusion.

AXIS participated in the Bloomberg Gender Equality Index, an index of public companies committed to disclosing their efforts to achieve gender equality, to build greater parity between genders within our organization. This participation, in turn, earned AXIS inclusion in the 2021 Bloomberg Gender Equality Index.

Our Communities: Philanthropy

Our philanthropy strategy focuses on organizations that drive awareness and action important to our company, people, communities and industry. AXIS has a long history of supporting charitable causes that align with our values. Our giving comes in many forms:

In 2020, AXIS donated $1 million to support COVID-19 relief efforts, including $100,000 to support underserved communities that have been particularly impacted by the pandemic.

Each year we host a Global Giving Rally, a period of time when colleagues can use paid time off to volunteer at local organizations. We also offer one additional paid day off to volunteer at any point during the year. In 2020, we shifted the initiative to a virtual setting.

As part of our investment in communities, AXIS sponsors a Matching Gifts Program, which is now in its thirteenth year of operation. In 2020, AXIS’ combined philanthropic activity supported over 570 non-profit organizations.

| ||||||

Our Voice: Advocacy

AXIS focuses its advocacy efforts on driving significant change in the (re)insurance industry by promoting issues, policies and initiatives that are supportive of our values, our corporate citizenship pillars and our stakeholders.

For example, in terms of environmental and climate change advocacy:

AXIS continues to partner with leading researchers and students at the University of Illinois’ Office of Risk Management and Insurance Research. This partnership is creating new natural catastrophe risk conceptualization models that leverage data analytics and computer programming.

AXIS partnered with AIR Worldwide and scholars from the Brookings Institution to publish “Quantifying the Impact from Climate Change on U.S. Hurricane Risk,” a research study addressing how climate change may affect hurricane risk in the United States by 2050, specifically related to residential and commercial properties. This paper included information from University of Illinois research fellows funded by AXIS.

We expanded our work with the Insurance Development Forum (“IDF”), a public-private partnership that seeks to optimize and extend the use of insurance to address social, economic and environmental issues. We joined additional IDF working groups, including the Sovereign & Humanitarian Solutions working group, which focuses on the development of new insurance solutions for sovereigns, sub-sovereigns, international institutions and humanitarian agencies. We continue to play a leadership role as our CEO, Albert Benchimol, serves on the IDF Steering Committee; and

AXIS remains a member of the Bermuda Institute of Ocean Sciences’ Risk Prediction Initiative, which was formed in the wake of Hurricane Andrew in 1992. The Risk Prediction Initiative was formed in part to improve models for natural catastrophes and better estimate probable loss distributions.

In terms of diversity and inclusion advocacy:

AXIS participated in the 2020 Lloyd’s Dive In festival, an initiative focused on diversity, equity and inclusion in the insurance industry, by sponsoring and participating in local committees in Atlanta, Bermuda, London, New York City and Zurich.

|

employees.

| ||||

| ||||||||

| 24 | CORPORATE GOVERNANCE | |||||||

In 2022, on average 80% of employees participated in our biannual employee surveys. We are proud to have maintained strong survey engagement and scores in a year of organizational change.members)members and drive strong employee performance), (ii) community building events for AXIS employees and their families and (iii) our employee-led charitable giving program which helps our employees give back to their communities.During 2020, In addition, to provide an open and frequent line of communication between senior management and our employees, we conducted anhost all-employee calls led by our CEO on a monthly basis and we encourage our people managers to periodically check in with their employees.survey, measuring engagementsurveys to better understand and inclusion.improve the employee experience and identify opportunities to strengthen our culture. These surveys are conducted once in the spring and a second in the fall. Managers and teams reflectedreflect on the survey results and developeddevelop enterprise-wide and local action plans to address areas identified for growth.performance and deliver equal pay for equal work.performance. Our compensation packages align with our pay-for-performance philosophy and are assessed on an annual basis through year-end performance reviews. Our packages are also regularly benchmarked against similarly-sized specialty insurance, reinsurance and financial services companies in each of our talent markets.companies. Compensation components include market competitive salaries and short-term annual incentive programs (i.e., bonus payments) and, for senior level employees, long-term incentives such as equity grants. Our comprehensive benefits packages include medicalpaid time off, health and welfare plans for employees and their families, flexible spending accounts, retirement savings plans with employer contributions and work-life benefits, including parental leave policies, flexible work arrangements for eligible employees and charitable matching programs. In light of the COVID-19 pandemic, in 2020, the Compensation Committee also received a report on the emergency succession plan for the Executive Committee.

22CORPORATE GOVERNANCE

25

Employees

| North America (including Bermuda) | 1,295 | |||||||||

| ||||||||||

Europe, Middle East and Africa | ||||||||||

| 747 | ||||||||||

Asia Pacific | ||||||||||

| 22 | ||||||||||

Total employees | 2,064 | |||||||||

| Women | Men | |||

Total employees (1) | 43% | 55% | ||

|

| Women | Men | |||||||

Total employees(1) | 45% | 54% | ||||||

| ||

| ||

| ||

| ||

| ||

|

|

All U.S. Employees(1) | |||||||

| 16% | ||||||

| Asian | |||||||

| Hispanic / Latinx | 5% | ||||||

| White | |||||||

| Multiracial, Native American and Pacific Islander | 2% | ||||||

| No Response / Not Disclosed | 7% | ||||||

| Total employees | 100% | ||||||

| PRINCIPAL SHAREHOLDERS | |||||

• Each person or group known to us to be the beneficial owner of more than 5% of our common shares

• Each of our directors

• Each of our named executive officers

• All of our directors and executive officers as a group

| Directors and Executive Officers | Number of Common Shares (1) | Percent of Outstanding Common Shares (1) | ||||

Albert A. Benchimol | 409,131 | * | ||||

W. Marston Becker | 9,775 | * | ||||

Charles A. Davis (2) | 44,083 | * | ||||

Anne Melissa Dowling | 5,703 | * | ||||

Elanor R. Hardwick | 6,188 | * | ||||

Thomas C. Ramey | 15,552 | * | ||||

Henry B. Smith | 49,541 | * | ||||

Axel Theis |

| — |

| * | ||

Barbara A. Yastine | 8,337 | * | ||||

Lizabeth H. Zlatkus | 8,110 | * | ||||

Steve K. Arora | 52,186 | * | ||||

David S. Phillips | 36,858 | * | ||||

Peter J. Vogt | 38,724 | * | ||||

Peter W. Wilson | 54,850 | * | ||||

All directors and executive officers as a group (14 persons) (7) | 739,038 | * | ||||

| OTHER SHAREHOLDERS | ||||||

T. Rowe Price Associates, Inc. (3) | 10,682,555 | 12.6% | ||||

The Vanguard Group (4) | 7,518,425 | 8.9% | ||||

T-VIII PubOpps LP (5) | 6,777,086 | 8.0% | ||||

Pzena Investment Management, LLC (6) | 6,596,786 | 7.8% | ||||

| DIRECTORS AND EXECUTIVE OFFICERS | Number of Common Shares (1) | Percent of Outstanding Common Shares (1) | ||||||

| Albert A. Benchimol | 521,448 | * | ||||||

| W. Marston Becker | 14,190 | * | ||||||

Charles A. Davis (2) | 52,907 | * | ||||||

| Anne Melissa Dowling | 10,118 | * | ||||||

| Elanor R. Hardwick | 12,357 | * | ||||||

| Michael Millegan | 4,853 | * | ||||||

| Thomas C. Ramey | 19,967 | * | ||||||

| Henry B. Smith | 55,710 | * | ||||||

| Axel Theis | 5,296 | * | ||||||

| Barbara A. Yastine | 12,752 | * | ||||||

| Lizabeth H. Zlatkus | 16,483 | * | ||||||

| Peter J. Vogt | 56,104 | * | ||||||

| Vincent C. Tizzio | 11,429 | * | ||||||

| David S. Phillips | 52,608 | * | ||||||

| Conrad D. Brooks | 31,943 | * | ||||||

| Steve K. Arora | 33,788 | * | ||||||

| Peter W. Wilson | 6,999 | * | ||||||

All directors and executive officers as a group (16 persons) (3) | 881,159 | 1% | ||||||

| OTHER SHAREHOLDERS | ||||||||

T. Rowe Price Investment Management, Inc. (4) | 10,193,257 | 12.0% | ||||||

The Vanguard Group, Inc. (5) | 8,281,280 | 9.7% | ||||||

Pzena Investment Management, LLC (6) | 5,543,905 | 6.5% | ||||||

T-VIII PubOpps LP (7) | 6,777,806 | 8.0% | ||||||

|

|

|

|

| ||||||||||

| 27 | |||||||||

|

|

|

|

DELINQUENT SECTION 16(a) REPORTS

Under Section 16(a)

We believe that all of our directors, executive officers and shareholders who are requiredinformation set forth below is based solely on information contained in Amendment No. 9 to file reports filed all of such reports on a timely basis during 2020 except that, due to an administrative error, the Form 4 originally filed for Albert Benchimol on January 30, 2020 incorrectly reported the amount of restricted stock units awarded on January 28, 2020. An amended Form 4 wasSchedule 13G/A filed on February 4, 20209, 2023 by The Vanguard Group, Inc., 100 Vanguard Blvd., Malvern, PA 19355, and includes common shares beneficially owned as of December 31, 2022. Vanguard has sole dispositive power over 8,281,280 common shares. Vanguard has shared voting power over 48,177 common shares and shared dispositive power over 124,585 common shares.

| ||||||||

| PRINCIPAL SHAREHOLDERS | |||||||

| Name | Age | |||||||

Albert A. Benchimol (1) | 65 | Chief Executive Officer, President and Director | ||||||

| Peter J. Vogt | 59 | Chief Financial Officer | ||||||

Vincent C. Tizzio(2) | 56 | Chief Executive Officer, Specialty Insurance and Reinsurance | ||||||

| David S. Phillips | 54 | Chief Investment Officer | ||||||

| Conrad D. Brooks | 61 | General Counsel | ||||||

| 43 | |||||||

Peter J. Vogt | ||||||||

| ||||||||

| ||||||||

| ||||||||

|

Peter J. Vogt |

|

David S. Phillips | David S. Phillips joined AXIS as Chief Investment Officer in April 2014. With over 25 years of experience in investments, Mr. Phillips previously served as Head of Investments for |

| |||||

| Conrad D. Brooks | Conrad D. Brooks serves as General Counsel of AXIS Capital. Prior to his appointment to the role in January 2017, he served for nearly a decade as the Company’s Corporate Counsel. Mr. Brooks joined AXIS from McKenna Long & Aldridge LLP (now Dentons), where he was a partner and served as a practice team leader in the firm’s corporate and securities practice. A former officer in the United States Navy, Mr. Brooks received his B.S. from the University of Illinois, his J.D. from Georgia State University College of Law and his M.B.A. (Finance) from Old Dominion University. | ||||

| Daniel J. Draper | Daniel J. Draperwas appointed Group Chief |

| ||||||||||

| 29 | |||||||||

Process."

2024.

| PROPOSAL | ||||||||

LETTER FROM THE COMPENSATION COMMITTEE CHAIRMAN

Dear Fellow Shareholder,

OverIn accordance with the courserequirements of Section 14A of the past year, I hadExchange Act (which was added by the opportunityDodd-Frank Act) and the related rules of the SEC, we are including in the proxy statement a separate resolution subject to speak with manyshareholder vote to determine, in a non-binding vote, whether a shareholder vote to approve the compensation of you directly,our named executive officers (that is, votes similar to the non-binding vote in connection with our 2020 Annual Meeting and our fall outreach program. During these meetings, we discussed key topics, such as:

Our executive compensation practices, including changes made to our program to further align pay and performance;

Our Board composition, including diversity and skills criteria and

Environmental, social and other sustainability topics, such as diversity, equity and inclusion initiatives and human capital management;

Transparency in disclosuresof Directors has determined that an advisory vote on executive compensation that occurs every year is the most appropriate policy for AXIS at this time, and therefore our Board of Directors recommends that you vote for future advisory votes on executive compensation to occur annually.

The impact

| PROPOSAL 3. NON-BINDING VOTE ON THE FREQUENCY OF SHAREHOLDER VOTES ON EXECUTIVE COMPENSATION |  | |||||||

| 30 | ||||||||

| LETTER FROM THE HUMAN CAPITAL AND COMPENSATION COMMITTEE CHAIRS | |||||

Performance and pay outcomes in 2020

Our financial results fell short of expectations in 2020. As During our 2022 outreach discussions, our shareholders continued to express strong support for our non-financial goals, the exceptional collaboration among our leadership team in the face of an extraordinary yearexecutive compensation philosophy and the degree of progress made on the Company’s long-term strategy was exemplary. However, given that our Chief Executive Officer is ultimately accountable for our financial results, the Compensation Committee felt it was important that his annual incentive non-financial performance payout not exceed 100%, resulting in a bonus equal to 30% of target. Despite the pay outcome, the Committee still recognizes the Chief Executive Officer’s excellent stewardshipprograms, and approximately 93% of the Company, redefiningvotes cast at our organizational culture and preparing the Company for future success during a year of unparalleled macro events.

Changes in2022 Annual General Meeting supported our executive compensation structure in 2020 and 2021

programs.

As detailed further in this proxy statement, the Compensation Committee made the following changes to our compensation program in 2020 and 2021:

Adjusted the annual incentive mix for our Chief Executive Officer to place a higher weighting on the Company’s OROACE results, effective with his 2020 incentive award.

Revised the PSU payout scale effectivewe welcome continued dialogue with our 2021 grants (for performance year 2020).

Increased the weighting of the Company’s OROACE in the annual incentive mix for all other NEOs, emphasizing the importance of group financial results (for performance year 2021).

How the Committee considered the impact of COVID-19 on executiveshareholders regarding AXIS' compensation

The Compensation Committee met several times to thoughtfully consider the impact of COVID-19 on our executive compensation program. The Committee sought to balance acknowledging the Company’s financial results, while recognizing our executives for their unwavering efforts and leadership throughout the pandemic. In consultation with Korn Ferry, the Committee determined:

No modifications would be made to the financial goals under our annual incentive plan or to the performance assessment of outstanding PSUs to account for the impact of COVID-19.

A modest adjustment was made to the non-financial annual incentive performance payout specific to each NEO to reflect their role in the Company’s response to the pandemic.

20% of each NEO’s annual incentive bonus will be delivered in RSUs that vest on a pro-rata basis over three years (in lieu of cash) consistent with the approach taken with other senior employees in our organization.

As you review the discussion and analysis of our compensation program in the proxy statement, I believe that you will find the actions taken in 2020 align with the interests of our shareholders and incentivize growth in the long-term. programs. Thank you for your continued support of AXIS.

support.

Chairman of the Board

(Former Chair, Human Capital and Compensation Committee Chair

| LETTER FROM HUMAN CAPITAL AND COMPENSATION COMMITTEE CHAIRS | |||||||

| 31 | |||||||

| Name | Page | |||||||

Leadership Transition | ||||||||

Company Performance | ||||||||

| Positive 2022 Say on Pay Vote and Shareholder Engagement | ||||||||

| Strong Link Between Pay and Performance | ||||||||

2022 Pay and Performance – CEO Compensation | ||||||||

The

| ||

| ||

| ||

| ||

| ||

In fiscal year 2020, AXIS faced the combination of severe catastrophe events and the global COVID-19 pandemic, making 2020 the fifth costliest catastrophe year on record, impacting our financial performance, as well as the industry overall. Nonetheless, fiscal year 2020 marked a year of significant progress in our core underwriting performance and portfolio optimization efforts. Despite our 2020 financial results, we believe AXIS enters 2021 with a stronger and more balanced book of business and is well-positioned for future profitable growth.

Company Performance

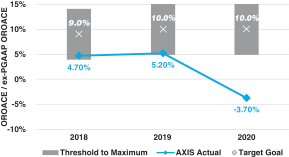

OROACEwas the financial metric used for evaluating cash bonus awards under our Annual Incentive Plan. Relative TSR was the Company’s financial metric for the PSUs granted in 2020.

AXIS Capital’s 2020 financial results for these performance metrics on an absolute basis are set forth below:

| ||

| ||

| ||

|

|

| Name | Title | ||||||

Albert A. Benchimol(1) | Chief Executive Officer and President | ||||||

| Peter J. Vogt | Chief Financial Officer | ||||||

Vincent C. Tizzio(2) | Chief Executive Officer, Specialty Insurance and Reinsurance | ||||||

| David S. Phillips | Chief Investment Officer | ||||||

| Conrad D. Brooks | General Counsel | ||||||

Steve K. Arora(3) | Former Chief Executive Officer, AXIS Reinsurance | ||||||

Peter W. Wilson(4) | Former Chief Executive Officer, AXIS Insurance | ||||||

(1)Mr. Benchimol will no longer serve as Chief Executive Officer, President and Director effective as of the close of business on May 4, 2023. He will serve as a strategic advisor through December 31, 2023. | |||||||

(2) Mr. Tizzio will succeed Mr. Benchimol as Chief Executive Officer and President effective as of the close of business on May 4, 2023. Mr. Tizzio became the CEO of AXIS Insurance on June 1, 2022 and transitioned to CEO, Specialty Insurance and Reinsurance, an expansion of his previous role, on June 7, 2022. | |||||||

(3) Mr. Arora departed AXIS on December 31, 2022. | |||||||

(4) Mr. Wilson departed AXIS on December 31, 2022. | |||||||

| ||||||||

| 32 | COMPENSATION DISCUSSION AND ANALYSIS | |||||||

Progress

Several years ago, we launchedMay 4, 2023, and thereafter, he will serve as a multiyear transformation program focused on delivering more proactive capital allocationstrategic advisor through December 31, 2023.

While COVID-19 and numerous catastrophe events impacted our financial performance. Despite a challenging backdrop of catastrophic events, such as the Russian-Ukraine war, severe weather, and the continued pandemic impact, we delivered solid financial results - highlighted by record premium production ($8.2 billion in FY 2022, compared to $7.7 billion in FY 2021) and improved underwriting metrics (combined ratio of 95.8% for the year, the challenging environment caused by the global pandemic did not change or slow the execution of our strategic priorities. Instead, it served as a catalystFY 2022 compared to further accelerate these initiatives. 97.5% for FY 2021).

Continuing

Delivered higher quality portfolio and reduced volatility, achieving record: $8.2 Billion Gross Premiums Written | Accelerated expansion as leading specialty insurer, with Insurance business growing: 15% We also repositioned our complementary reinsurance book in the specialist space in FY 2022. | |||||||

Delivered more agile and efficient organization. The Insurance segment’s Underwriting G&A Expense Ratio decreased: 2 pts 14.2% in 2022, compared to 16.2% in 2021. | Invested in high performing people and culture, advancing our ESG, DEI and engagement initiatives earning: Top Ranking In “Overall Commitment to ESG" in the Insurer's Lloyd’s 2022 ESG Survey and other recognitions. | |||||||

| ||||||||

| COMPENSATION DISCUSSION AND ANALYSIS | 33 | |||||||

| Measure | Fiscal Year 2022 | Change versus Fiscal Year 2021 | ||||||

OROACE (1) | 11.1% | +2.0% pts | ||||||

Adjusted OROACE(2) | 10.2% | N/A | ||||||

ROACE(3) | 4.3% | -7.9% pts | ||||||

Total Shareholder Return(4) | 2.6% | -9.2% pts | ||||||

(1) OROACE is a non-GAAP financial measure as defined in Item 10(e) of SEC Regulation S-K. The reconciliation to the most comparable GAAP financial measure, ROACE, along with a discussion of the rationale for the presentation, is provided in Appendix 1. | ||||||||

(2) Adjusted OROACE is a non-GAAP financial measure as defined in Item 10(e) of SEC Regulation S-K. The reconciliation to the most comparable GAAP financial measure, ROACE, along with a discussion of the rationale for the presentation, is provided in Appendix 1. | ||||||||

(3)One-year Total Shareholder Return with dividends reinvested, sourced from Bloomberg. | ||||||||

Scaling priority, high-growth business. We progressed digital offerings for attractive professional lines and progressed our capability to innovate around product offerings for micro customers.

Advancing automation and digitization processes. The Company took measures to scale in attractive businesses, reduce distribution and G&A costs over the long-term and focus underwriters on high value-added risk selection.

Progressing One AXIS, high performance culture. We progressed our high performance, One AXIS culture, improving employee engagement as measured in our enterprise-wide engagement survey and advancing our diversity, equity and inclusion initiatives.

POSITIVE 2020 SAY ON PAY VOTE AND SHAREHOLDER ENGAGEMENT

At our 20202022 Annual General Meeting, approximately 93%93.0% of the votes cast were in favor of our advisory vote on executive compensation.

| ||||||||||

| COMPENSATION DISCUSSION AND ANALYSIS |  | |||||||||

What We Heard | What We Did | ||||||||||

Executive Compensation: Annual Incentive | Reward executives on achievement of financial goals and strategic objectives; provide clear disclosure around | For the CEO, maintained a 75% financial metric weighting and 25% weighting for non-formulaic metrics. For all other NEOs, increased the weighting of the Company’s |

| ||||||||

| |||||||||||

Executive Compensation: PSUs | Ensure that PSUs have a direct alignment with Company |

| Since the | ||||||||

The range of the payout scale will also remain at 0% to 200%. | |||||||||||

| ESG Disclosure | Publish additional ESG-related reports and expand climate-related disclosures. | In 2022, we published our inaugural Task Force on Climate-Related Financial Disclosure-aligned report, which discusses the impact of climate-related risks and opportunities on our business and strategy, climate risk management, climate-related governance within the Company and our climate-related metrics and targets. In addition, we have published our estimated Scope 1, Scope 2 and certain Scope 3 greenhouse gas emissions for fiscal years 2019 through 2021. | |||||||||

| ||||||||

| COMPENSATION DISCUSSION AND ANALYSIS | 35 | |||||||

| What We Heard | What We Did | |||||||

| GHG Reduction Goals | Publish emission reduction goals and advance climate change mitigation initiatives. | In support of its commitment to mitigate climate change and support the transition to a low-carbon economy, the Company published GHG emissions reduction goals. | ||||||

| Workforce Disclosure | Expand reporting of the Company's demographic metrics. | Beginning in 2022, we have disclosed quantitative metrics reflecting the gender, race and ethnicity of our workforce, as permitted by laws and regulations. | ||||||

| Board Oversight of ESG Matters | Explain Board and committee oversight of ESG. | We have formalized our Board and committee oversight of ESG as described below: Our Corporate Governance, Nominating and Social Responsibility Committee oversees our ESG and sustainability initiatives. In 2021, the Corporate Governance, Nominating and Social Responsibility Committee delegated oversight of human capital management, a component of the Company's ESG program, to the In connection with this change, the Corporate Governance, Nominating and Social Responsibility Committee, formerly known as the Corporate Governance and Nominating Committee, was renamed to formalize its primary responsibility for | ||||||

| Board Structure | Discuss rationale for the classified board structure. | The Board and the Corporate Governance, Nominating and Social Responsibility Committee engaged in a robust discussion on the appropriate board structure for the Company and its shareholders and will continue to consider the matter on an annual basis. See "Proposal 1. Election of Directors – Board Structure" for more information. | ||||||

COVID-19 COMPENSATION CONSIDERATIONS

In determining compensation for the 2020 performance year, the Compensation Committee did not modify the financial performance goals for the Annual Incentive Plan that were established at the beginning of the year, prior to the onset of COVID-19. As a result, the financial metric of the Annual Incentive Plan that relates to OROACE, resulted in a performance factor of 0%. Likewise, the Compensation Committee also did not modify or adjust the financial results for any of the outstanding PSUs to account for the impact of COVID-19.

Instead, the Compensation Committee determined it was appropriate to make a modest adjustment to the non-financial payment of each NEO to recognize each leader’s individual performance during the pandemic. In particular, the Committee recognized that in addition to pursuing the Company’s ongoing long-term strategy, eachand Performance

Lastly, to further align the 2020 annual incentive awards with AXIS’ long-term performance, the Committee decided to deliver 20% of each NEO’s annual incentive award in RSUs (in lieu of cash).

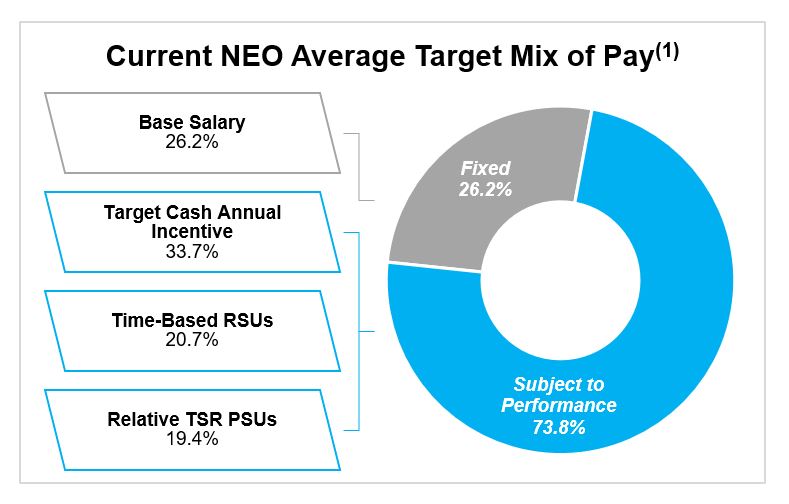

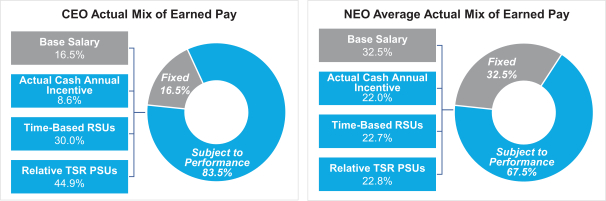

Pay and Performance—Compensation Structure

Our Compensation Committee is focused on maintaining a pay for performance orientation, while ensuring that executives are aligned with shareholders and the Company’s long-term goals.

| ||||

With that in mind, a substantial portion of our NEOs’ compensation is subject to performance. The below charts illustrate the 2020 actualtarget mix of pay for our CEO and other current NEOs for the 20202022 performance year:

| ||||||||

| 36 | COMPENSATION DISCUSSION AND ANALYSIS | |||||||

is performance-based. For our NEOs, on average, approximately 68%74% of their actual earnedtarget compensation was subject to performance.

The 2020 actualis performance-based. Averages include the NEOs that currently serve in leadership roles at the Company: Messrs. Vogt, Tizzio, Phillips, and Brooks. Messrs. Arora and Wilson are excluded, since they did not receive equity grants for the 2022 performance year and their ultimate mix of earnedawarded pay for the 2022 performance year was in accordance with the separation provisions in their employment agreements.

| ||||||||

| COMPENSATION DISCUSSION AND ANALYSIS | 37 | |||||||

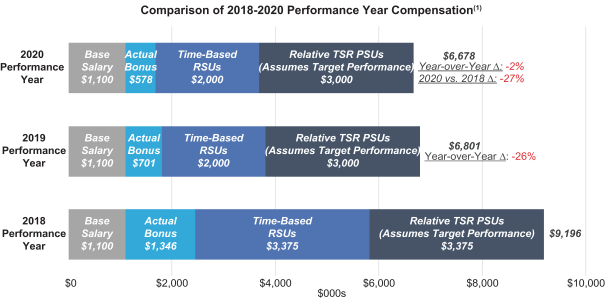

| 2020 Performance Year | 2021 Performance Year | 2022 Performance Year | |||||||||

| Base Salary | 1,100 | 1,100 | 1,100 | ||||||||

| Actual Bonus | 578 | 2,276 | 2,002 | ||||||||

RSUs (Time-Based) | 2,000 | 2,700 | 2,000 | ||||||||

Relative TSR PSUs (Assumes Target Performance) | 3,000 | 4,050 | 3,000 | ||||||||

| Total Performance Year Compensation | 6,678 | 10,126 | 8,102 | ||||||||

Pay Further, the graph and Performance – CEO Compensation

Our CEO demonstrated strong leadershiptable above reflect the fair market value of the equity compensation at the time of grant communicated to our NEOs for compensation purposes, as opposed to the value of the equity awards under Monte-Carlo simulation (as required by accounting rules and advanced the Company’s long-term strategic achievements during a year characterized by an extraordinary global pandemic and severe catastrophe events. Nonetheless, to reinforce our commitment to a clear link between pay and performance, the Compensation Committee approved the following with respect to CEO compensation for the 2020 performance year:

No base salary increase

Bonus was paid at 30% of target, resulting in a 18% decreasereflected in the CEO’s actual annual incentive award year-over-year

No increase in equity awards from prior year